Breitbart Business Digest: Scott Bessent Explains Trump’s Interest Rate Policy

We got some powerful support this week for our argument that President Trump is not demanding that the Federal Reserve cut interest rates.

We got some powerful support this week for our argument that President Trump is not demanding that the Federal Reserve cut interest rates.

On Wednesday’s broadcast of NewsNation’s “The Hill,” Sen. Pete Ricketts (R-NE) stated that the proposal to cap credit card interest rates at 10% from Sens. Josh Hawley (R-MO) and Bernie Sanders (I-VT), which is an idea President Donald Trump has

Jerome Powell did a fine job at his press conference Wednesday of staying out of the way of politics despite being peppered with questions from reporters practically begging him to weigh in against President Donald Trump’s policies.

A resilient labor market, the improving outlook among small businesses, and persistent inflation pressures are signals that the Fed’s September and October rate cuts may have been premature.

The Federal Reserve’s rate-cutting cycle has very likely come to an end—although it may take Fed officials several months to figure this out.

Federal Reserve officials this week came as close as they are probably ever going to get to admitting that the aggressive interest rate reduction they enacted weeks before the 2024 election was a mistake.

Federal Reserve officials appear poised to repeat the mistake of September and November by cutting interest rates again when the economic data clearly calls for a pause.

On Friday’s broadcast of Bloomberg’s “Balance of Power,” White House Council of Economic Advisers Chair Jared Bernstein stated that bond market interest rates and mortgage rates have increased and that’s partially due to “the stronger economy” under President Joe Biden,

The latest economic data suggests that the Federal Reserve should halt any further rate cuts.

After the Fed’s surprise 50-basis-point cut in September, the burning question now is whether the central bank overplayed its hand.

The Federal Reserve’s 50-basis-point rate cut in September wasn’t just premature—it was driven by political pressures.

During an interview with CNBC on Thursday, Treasury Secretary Janet Yellen responded to a question on if she thinks the Federal Reserve has rates that are too high by stating that the Fed’s members expect rates to be cut and

Fed officials now think it will take a higher rate to sustainably achieve two percent inflation.

We have discovered something that the supporters of Kamala Harris and Donald Trump agree on: the Federal Reserve’s half-point interest rate cut this week was a political gift to Harris.

The Federal Reserve’s decision on Wednesday to begin lowering interest rates raises the question of how fast rates should be expected to decline.

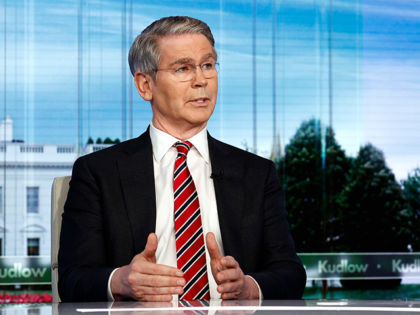

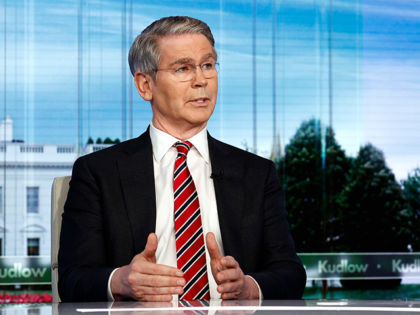

On Wednesday’s broadcast of the Fox Business Network’s “Kudlow,” Breitbart News economics editor John Carney stated that the Federal Reserve should have waited until after the election to make rate cuts and that by announcing a cut of 50 basis points

As the Fed prepares to cut rates again, it’s worth remembering that rate cuts are never free, even when they seem like an easy fix. For the market, it’s always fun while it lasts, but the reckoning is rarely far behind.

If the Biden-Harris administration’s policies are not hurting the economy, why are prominent Democrats urging the Federal Reserve to announce a super-sized interest rate cut?

Another landmark for the Biden-Harris administration.

Home prices, and therefore the American Dream, are the most “unaffordable … in history,” according to the latest data.

The federal funds futures market is pricing in a cut in each of the remaining three meetings of the Federal Open Market Committee this year.

Cutting rates too quickly could lead to a resurgence of inflation, forcing the Fed into a tighter monetary policy stance down the road.

Kamala Harris has come up with economic ideas so awful even the pro-Kamala media are ripping them as “gimmicks” and “not sensible.”

Thanks to brutal inflation and equally brutal interest rates, 59 percent of Americans believe this country is in a recession.

The economists are probably right and the market is probably wrong when it comes to forecasting the Fed’s interest rate policy over the remainder of this year.

Absent some economic catastrophe, there’s almost no chance of an emergency rate cut in August.

On Monday’s broadcast of “CNN News Central,” Rep. Adam Smith (D-WA) responded to the tumble in the stock market by stating that the Federal Reserve needs to cut interest rates and “inflation is down pretty close to zero. And now,

It looks like the market is finally going to get what it has wanted for over a year—a rate cut from the Federal Reserve.

Democrats on Friday urged the nation’s central bank to cut interest rates now as the unemployment rate surged.

Leftists are desperate for the Federal Reserve to cut interest rates because they hamper the “country’s ability to combat the climate crisis.”

Donald Trump on Wednesday threw a monkey-wrench into the plans of Democrats to claim he wants to cut Social Security when he proposed ending federal taxes on the benefits of retirees.

Will Fed officials stick by their forecast of a single rate cut this year or capitulate to financial markets that are pricing in multiple cuts this year?

Economic growth picked up more than expected in the spring, not only undermining the case for rate cuts but also raising the possibility that the Federal Reserve still has not done enough to cool the economy off to bring inflation down to its two percent target.

Persistently high inflation under the policies of President Recep Tayyip Erdogan is decimating the Turkish tourism industry, as both foreign visitors and locals decide to save money by nipping over to Greece for holiday getaways.

The announcement that President Biden has halted his campaign to seek a second term puts pressure on the Federal Reserve to hold off on interest rate hikes until after the election.

High interest rates are still weighing down building in the single-family home market.

A Fed rate cut on the eve of the election would inevitably be seen as a partisan political gift to incumbent Joe Biden and would invite backlash from Republicans.

Federal Reserve Chair Jerome Powell explicitly refused to offer forward guidance about interest rate policy in his Capitol Hill testimony this week, which we think is an indication that a rate cut in September is unlikely.

The biggest underpriced risk in the market is still a hike from the Federal Reserve.

Only seven percent of voters believe President Joe Biden’s economy is “very good,” a CBS News poll recently found.