L.A. Wildfires Could Cost Up to $150 Billion, AccuWeather Warns

The economic toll of the L.A. fires continues to mount.

The economic toll of the L.A. fires continues to mount.

The Fed’s one hundred basis points in cuts at the end of last year has ignited fears of surging inflation.

Businesses ramped up hiring much more than expected in the month after Donald Trump won the presidential election.

It is not just the bond market that is having doubts about the stance of monetary policy. Federal Reserve officials are also seeing the light.

The wildfires sweeping across Southern California have already caused an estimated $52 billion to $57 billion in damages and economic losses, according to preliminary assessments from AccuWeather. The blazes, which have forced mass evacuations and disrupted daily life, are being

The great clash between Donald Trump and the Federal Reserve may not happen after all.

Employers added 122,000 jobs last month on a seasonally adjusted basis, down from 146,000 in November and well below the 134,000 forecast by economists surveyed by Econoday.

Greenland is one of those rare geopolitical assets that might actually be worth it to buy. So, how much would it cost?

The U.S. services sector posted stronger-than-expected growth in December, signaling a potential acceleration in the economy as businesses look ahead to the incoming Trump administration’s pro-growth policies. The Institute for Supply Management’s (ISM) purchasing managers’ index for the services sector

Job openings came in significantly higher than even the most optimistic forecasts.

The evidence keeps mounting that the election of Donald Trump to a second presidential term is already causing an economic acceleration.

The Fed’s top banking supervisor is stepping aside to make room for Donald Trump’s agenda.

Richard A. Easterlin, a trailblazing economist whose insights reshaped our the postwar baby boom, died at his home in Pasadena, California, on December 16.

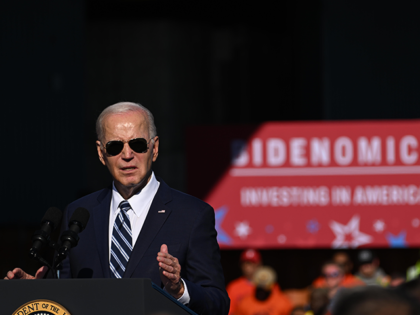

President-elect Donald Trump will not let Joe Biden’s ban on oil and gas drilling in certain federal waters stand in the way of providing Americans with inexpensive and abundant energy, according to spokeswoman Karoline Leavitt in an exclusive interview with Breitbart Confidential.

Americans are strolling into the new year with a bit more spring in their steps, thanks to the imminent return of Donald Trump to the White House and the long-awaited end of the Biden-Harris era.

Rising interest rates weighed on spending in November.

Biden’s dismissal of inflation concerns wasn’t just a verbal misstep. It was a bizarre signal that Biden wasn’t in touch with the policy discussion going on across the country.

A slightly better than expected report on inflation.

The U.S. economy will barely notice if the federal government needs to shut down because funding authorization runs out at 12:01 a.m. on Saturday, December 21.

Leading economic indicators increased in November, something they havent done since February 2022.

Federal Reserve officials this week came as close as they are probably ever going to get to admitting that the aggressive interest rate reduction they enacted weeks before the 2024 election was a mistake.

Concerns over more inflation and higher rates triggered a sharp sell-off on Wall Street.

The Federal Reserve announced the third consecutive cut in its interest rate benchmark on Wednesday, a move widely anticipated by investors and financial markets.

The Federal Reserve’s insistence that monetary policy is restrictive is looking more and more ridiculous.

The Fed seems bent on cutting rates again this month. Trump’s economic team is worried this could revive inflation.

“This is a monumental demonstration of confidence in America’s future,” Trump said.

President-elect Donald Trump’s recent support for the dockworkers of the International Longshoremen’s Association (ILA) should be viewed through the lens of dealmaking.

A super-majority of Americans, across racial and ethnic groups, think the stock market is important, according to the latest survey by YouGov for the Economist.

The latest sign that the fight against inflation is not yet won.

The Federal Reserve is about to triple down on its September rate cut mistake by reducing its benchmark for a third consecutive time next week.

Core inflation rises for the fourth straight month.

Trump’s tariffs, far from being the Grinch, may well be the unseen Santa, bringing the gift of a healthier trading system to the good little boys and girls of the world.

The outlook for business conditions in the coming months soared by 41 points, the largest monthly jump since the NFIB began collecting data in 1986, bringing the metric to its highest level in over four years.

The outlines of a Republican legislative agenda for Trump’s second term are beginning to take shape, but a key decision could send troubling signals to businesses and consumers.

The University of Michigan’s index of consumer sentiment rose in early December to its best reading since April, boosted by more positive views among Republicans and independents following the election of Donald Trump.

Economists had been expecting 215,000 after storms and strikes led to much-worse-than-expected growth in October.

Like so much economic analysis from the establishment, the Fed study on tariffs arrives with breathless findings of calamity, but it doesn’t stand up to scrutiny.

The good times are back again for America’s heartland.

A much larger drop than expected after the port strike was put on hold until next year.

The election of Donald Trump has already sparked a turnaround in sentiment among consumers and businesses, with the vibecession falling away and the rosy-fingered dawn of a new golden age spreading from sea to shining sea.