Breitbart Business Digest: Scott Bessent Explains Trump’s Interest Rate Policy

We got some powerful support this week for our argument that President Trump is not demanding that the Federal Reserve cut interest rates.

We got some powerful support this week for our argument that President Trump is not demanding that the Federal Reserve cut interest rates.

The University of Michigan’s gauge of consumer expectations for inflation over the next 12 months surged higher in early February, indicating that American households think inflation will go much higher over the coming year. Consumers expect prices to rise 4.3

While the headline jobs number was weaker than expected, there were upward huge revisions to earlier reports.

The Peterson Institute’s analysis is not a serious indictment of tariffs—it’s an unintentional case for their effectiveness.

One of the last of the American industrial conglomerates is splitting itself into three pieces.

President Trump’s inauguration has led to a surge in optimism and demand in the manufacturing sector.

A strong report overall still showed signs of weakness in manufacturing.

The final full month of the Biden presidency saw fewer job openings than expected.

Donald Trump has once again proven himself a more nimble negotiator than his critics understand.

The ISM manufacturing index registers expansion for the first time after 26 months in contraction territory.

Donald Trump won the debate on tariffs within the Republican Party and has greatly increased support for tariffs among all Americans.

White House press secretary Karoline Leavitt announced that a 25 percent tariff will be levied on goods from Mexico and Canada, while Chinese imports will face a 10 percent duty.

The latest numbers from the Commerce Department indicate that the inflationary legacy of Joe Biden is still with us.

When the details of Donald Trump’s tariff plans are eventually revealed, they’re almost certain to be lower than most Americans expect.

Business optimism and consumer sentiment surged after the election, likely giving a boost to fourth quarter GDP.

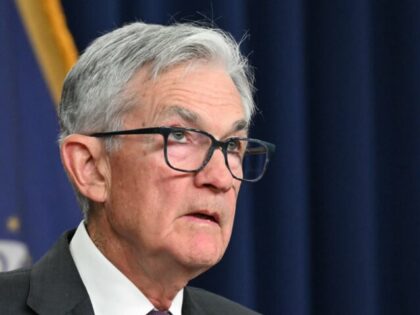

Jerome Powell did a fine job at his press conference Wednesday of staying out of the way of politics despite being peppered with questions from reporters practically begging him to weigh in against President Donald Trump’s policies.

Federal Reserve officials left interest rates unchanged in their first policy decision of 2025. “Recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months,

The Trump administration understands that only Congress can resolve the limbo of Fannie and Freddie and ensure the stability of America’s housing market.

President Trump’s tariff threat against Colombia demonstrated the power of economic leverage wielded with precision.

Americans bought new homes at a much faster pace in the month after the presidential election than analysts expected.

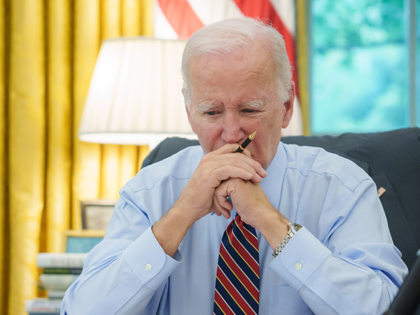

President Donald Trump’s signature bravado was on full display at the World Economic Forum in Davos this week as he vowed to “demand” lower interest rates from the Federal Reserve.

The latest S&P Global Flash U.S. Manufacturing PMI rose to 50.1 in January, inching above the threshold that separates expansion from contraction. This marks a significant turnaround for an industry battered by months of declining demand and production setbacks.

Investors who have convinced themselves—or been convinced by wealthy hedge fund managers talking their books—that the Trump administration is determined to release Fannie Mae and Freddie Mac from the government control are likely in for a painful surprise.

“With oil prices going down, I’ll demand that interest rates drop immediately, and likewise they should be dropping all over the world,” Trump, speaking via video from the U.S., told the audience of global leaders and business elites gathered in the Swiss alpine town.

Some of Wall Street’s most powerful financiers are likely to be disappointed by the Trump administration’s treatment of Fannie Mae and Freddie Mac.

President Trump’s first day executive orders make it clear that the administration plans to unshackle American energy production.

“Last week he announced that we are going to return America to greatness by creating—today is its birthday—the External Revenue Service,” Lutnick said at a rally in Washington after President Trump was sworn into office.

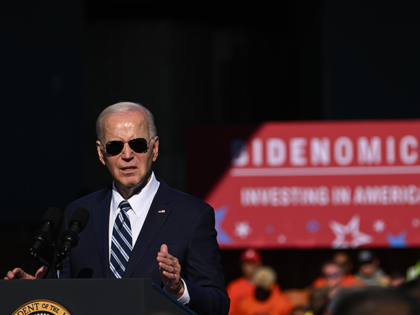

Joe Biden’s tenure as president will likely be remembered as an era of economic mismanagement, a vivid demonstration of what happens when the aimless pursuit of power combines with unbridled ideology to trump prudence.

America may be just about done with Joe Biden, but the malevolent economic legacy of his presidency is not done with us.

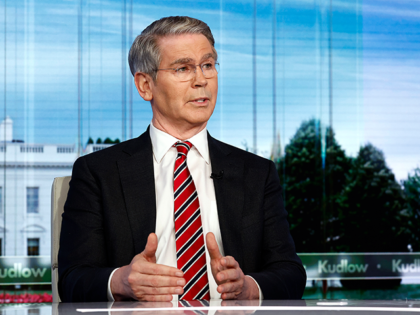

“This is the single most important issue of the day,” Bessent said.

“Trump was the first president in modern times to recognize the need to change our trade policy and stand up for American workers,” Besset will say.

The December CPI report is a sign that the Fed’s fight against inflation has stalled.

U.S. consumer prices climbed at a faster rate in December, capping off the inflation-plagued Biden administration’s final year and suggesting that the Federal Reserve’s efforts to bring down inflation may have run out of steam. The Consumer Price Index increased

A resilient labor market, the improving outlook among small businesses, and persistent inflation pressures are signals that the Fed’s September and October rate cuts may have been premature.

The end of the Biden administraiton and start of the next Trump era is kindling a new boom among small busineses.

The Federal Reserve’s rate-cutting cycle has very likely come to an end—although it may take Fed officials several months to figure this out.

Another relic of the woke, ESG, DEI craze crumbles.

The U.S. labor market is likely remain strong in the months ahead, signaling that the softness in the labor market seen in the middle of last year was transitory, according to monthly gauge of employment trends The Conference Board’s employment

The Federal Reserve’s reputation may not be burning down as rapidly as Los Angeles, but the outcome is likely to be the same: rubble, ashes, recriminations, and an expensive rebuilding.